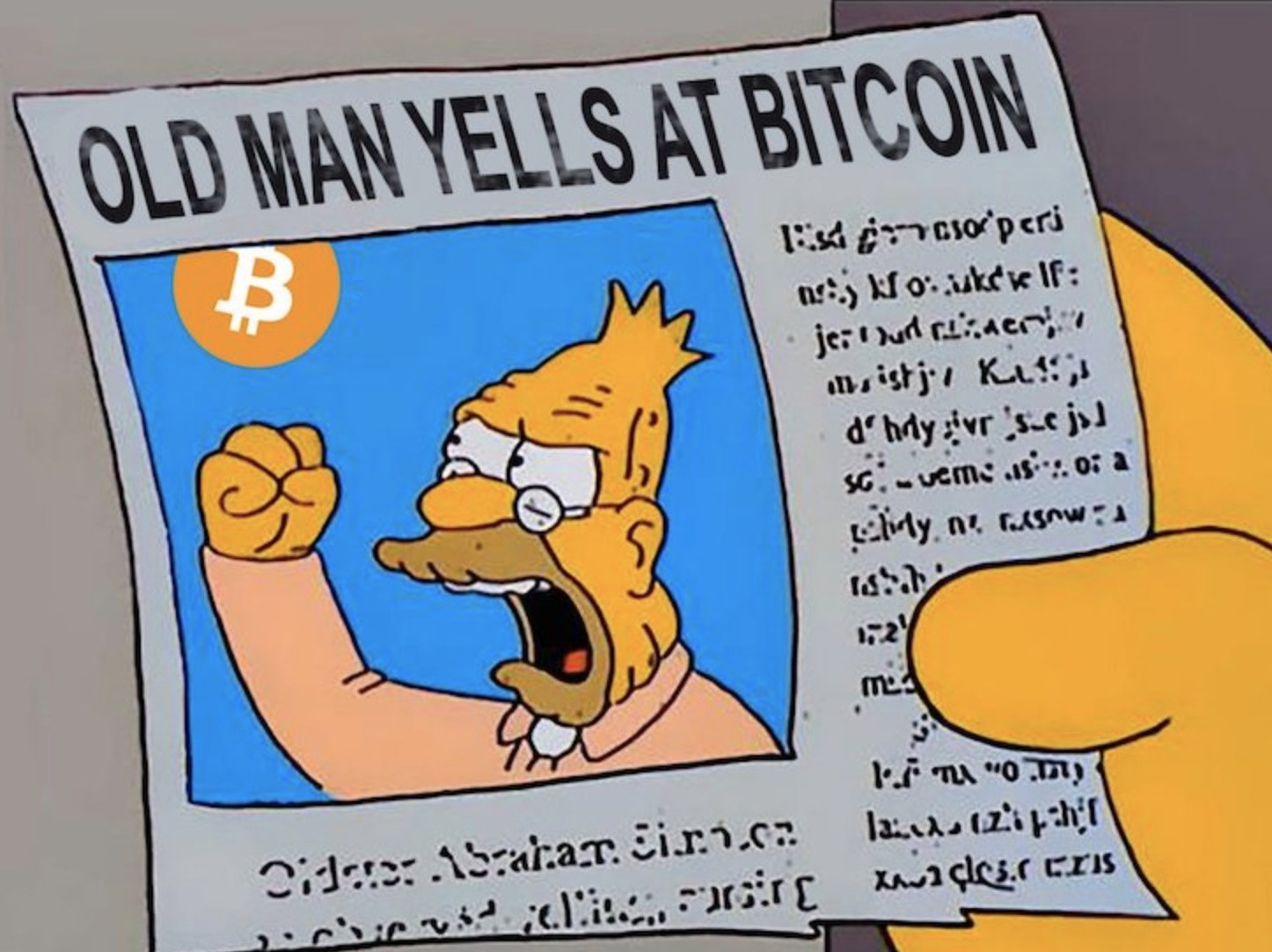

Mike Green is a staunch bitcoin critic but he's usually worth a listen. From a recent podcast with Danny Moses:

A truly hard-capped currency, as we're describing, can never be used for transactions because the risk of loss during a transaction... if it is non-zero, that closed system ultimately has a far higher cost of capital than any other system and it coalesces eventually to a single holder. It is a system built for wealth extraction and concentration.

I find this critique of bitcoin's hard cap to be the best I've heard yet, mainly because 1) loss is real, and 2) the growing pattern of corporations amassing large amounts aligns. The idea that this would greatly increase the cost of using bitcoin over time makes sense.

He later goes on to talk about putting bitcoin vs gold through a posiwid framework and how the exercise produces very different outcomes for each. This is related to the long-running deflationary vs inflationary money debate, but his main point is cogent (emphasis mine):

The fixed release schedule of bitcoin does not actually reward innovation. You can't speed up or increase the fraction of bitcoin regardless of the price of bitcoin. That actually means that the price of money rises relative to everything else in bitcoin and you end with a fantastically deflationary system.

Credit is a mechanism that allows people to access money before they have actually had the capacity to earn it all in advance and save it. It is a tool for the young to access capital before the old are willing to give it to them. And you can't have a debt-based system, you can't have a role for debt, in a deflationary currency. It's harder to pay that debt in the future than it is otherwise.

So, everything about bitcoin is actually bad for young people, except for the excitement of thumbing their nose at old people.