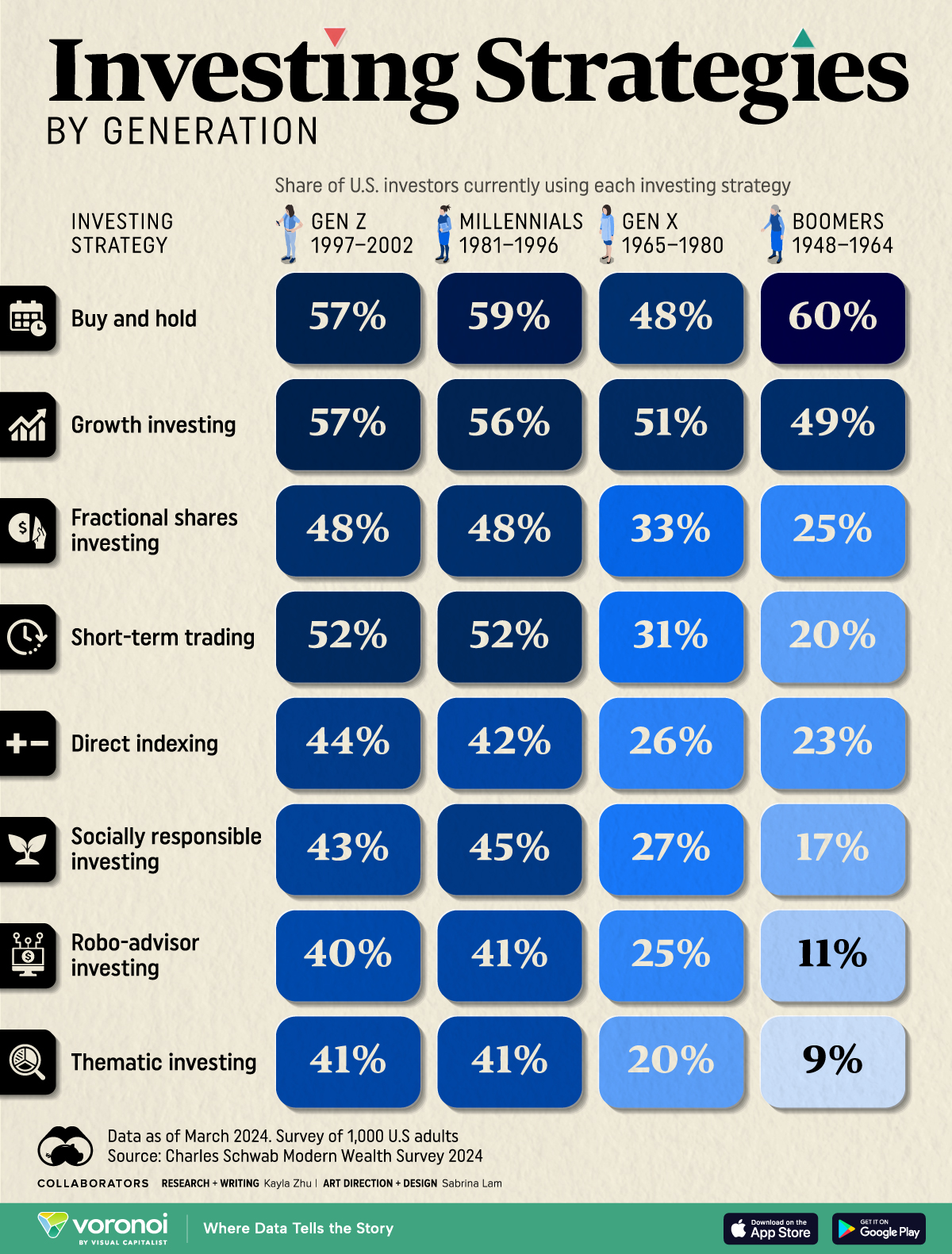

When it comes to investing, each generation has their own mix of strategies, and younger generations like to try a bit of everything.This graphic visualizes the breakdown of how each generation uses each of the following types of investing strategies:

- Buy and hold: Investors purchase stocks or assets and keep them long-term, regardless of short-term market fluctuations

- Growth investing: Investing in companies expected to grow at an above-average rate, even if their stock prices are higher

- Fractional shares investing: Purchasing a portion of a full share, allowing investors to invest in expensive stocks with smaller amounts of money

- Short-term trading: Buying and selling assets quickly, typically within days or weeks, to capitalize on short-term market movements

- Direct indexing: A method where investors buy and own individual stocks of an index directly rather than through a mutual fund or ETF, allowing for greater customization and tax efficiency

- Socially responsible investing: Investing in companies that meet specific ethical, environmental, or social criteria

- Robo-advisor investing: An automated investment service that uses algorithms to manage and optimize an investor’s portfolio, typically with low fees

- Thematic investing: A strategy centered on investing in companies tied to specific trends or themes, such as clean energy or technological innovation The data is based on a Charles Schwab Modern Wealth survey of 1,000 U.S. adults, and is updated as of March 2024.

pull down to refresh

related posts