Election battle

Bitcoin and, by extension, cryptocurrency somehow finagled their way into a favorable position during the recent US election cycle. Bitcoin got both major American political parties to try and "out-support" or "out-crypto" one another. Republicans seemed to get the head start in the pro-bitcoin race. This was headlined by talks at Bitcoin 2024 in Nashville by candidates Donald Trump and Robert Kennedy Jr. and Senator Cynthia Lummis. Pro-bitcoin candidates started receiving a lot of support in terms of voters and a lot of money as well. No doubt, these facts motivated Kamala Harris to pivot and begin to speak in a more bitcoin and crypto-friendly manner.

Thinking back to exactly two years prior, in November of 2022 when the FTX situation blew up, bitcoin has come a long, long way. In the FTX fallout, the buzzwords were scams, thievery, funding terror, and the need for crackdowns, regulation, an "anti-crypto army" and Operation Choke Point 2.0. The climate and future was bleak.

Fast forwarding to the 2024 campaign, in essence, bitcoin had somehow positioned itself in the fortunate spot where both major parties and candidates were essentially competing to be the most pro-bitcoin. Skeptics may rightly say, "I hear the talk, but show me the results." Still, compared to a couple of years ago, this was and is a good place to be.

What if...

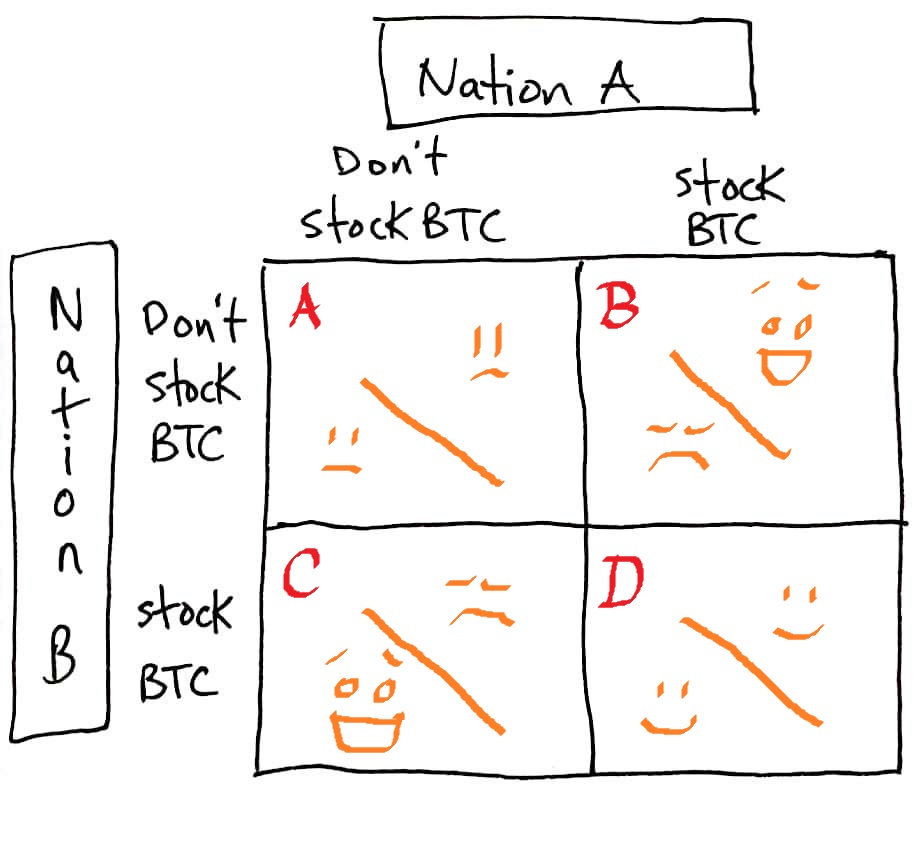

What if bitcoin could now finagle its way into a Bitcoin Cold War between the US and Russia and/or China or both? Or, what if bitcoin could get a cold war going between ANY and all other nations who wants to jump in?

Game theory

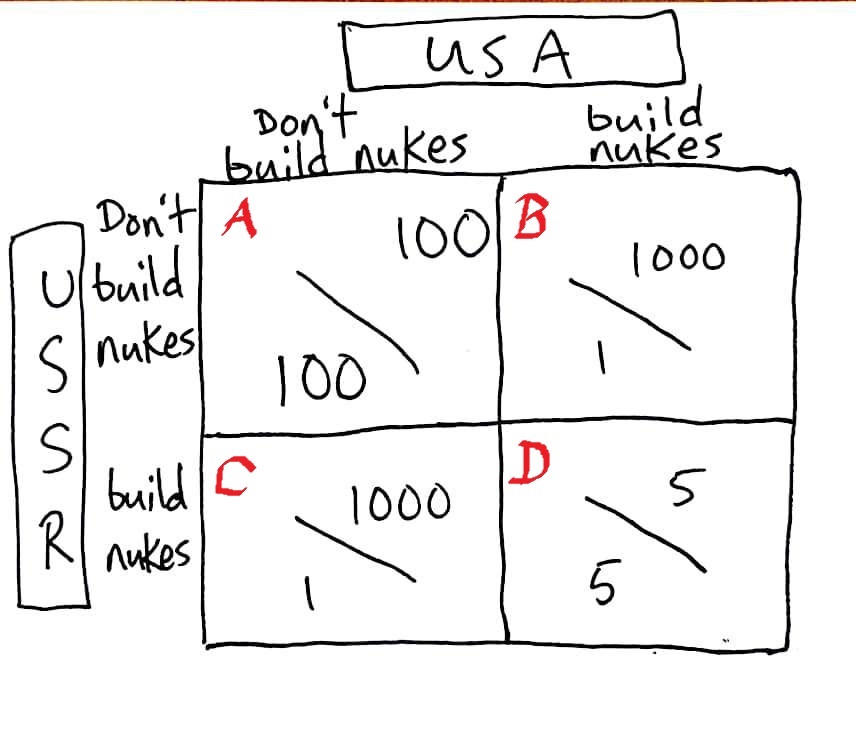

We learned in skool that the Prisoner's Dilemma (PD) was often applied to the old US vs USSR Cold War arms race. The nuclear arms race brought up this question: Why would rational nation-states spend billions to build immensely dangerous weapons with the whole intent of never using those weapons?

To be fair, the weapons were actually used...they were used to deter. They were not built with the intent to use as in firing the weapons, but they were built to deter the opposite side from firing theirs. So, in this way, they were in fact used. But, back to bitcoin...

President-elect Trump (and RFK Jr. and Senator Lummis) all spoke of a bitcoin strategic reserve or "stockpile" as Trump put it. (Sounds like nukes.) Russia and the BRICS nations have voiced the intent to create a currency to compete against the US dollar. Suppose Russia decided that bitcoin should be a part of that reserve currency. If Russia were to see the US buying bitcoin heading toward the goal of 1 million BTC as proposed by Sen. Lummis, the Prisoner's Dilemma may well kick in. Or, conversely, if Russia and BRICS were to move first on acquiring BTC, the US may see this as a very real economic threat and the Prisoner's Dilemma game theory would be game on.

In a way, the international game theory is already on. Bhutan has been mining bitcoin since 2019 and now holds over 12,500 BTC. El Salvador adopted bitcoin as legal tender in 2021. Since, they've been acquiring and hodling to the tune of just under 6,000 BTC. That's not huge, but it is 6,000 BTC and it's off-of-zero and that means...game on. What's more, the game may already be more widespread internationally than thought. This report estimates that nations hold 567,000 BTC (and it's outdated...notably with Germany having sold their BTC).

Bhutan and El Salvador are small countries getting a jump start and head start in the bitcoin cold war. If and when a larger nation with greater resources jumps in, well, we'll just have to see. Frankly, China and the US already might be in a bitcoin Cold War, see the image below:

But...numbers. The most critical number is 21 million. Another number is between 600,000 and 1.1 million BTC. That is the number of BTC that Satoshi Nakamoto apparently holds. And one other number is the 3.8 million lost-forever BTC. And that means scarcity.

So, 21 million, minus 850,000 that Satoshi holds (the mid-point between 600k and 1.1 M), minus 3.8 million lost, whittles the BTC supply down to 16,350,000.

If the US begins to pursue Senator Lummis' 1 million BTC goal, that would mean the US would hold 6.1% of all "liquid" bitcoin. As Russia or China or BRICS as a whole or every other nation saw that 16 million dwindling, the game theory FOMO would kick in hard.

I write FOMO because, with the Prisoner's Dilemma, a dynamic of we/they psychological gamesmanship ensues. The fear is that the other side WILL do something which will, in turn, slam our side in defeat. During the nuclear arms race, the fear was that the other side would build a massive nuclear stockpile. And, if our side did not stock weapons, they would then have a huge power imbalance over us. So, fearing this power imbalance, each side took the rational action and built the weapons.

The Prisoner's Dilemma usually is shown with "points" of some kind. The most ideal box would be box A with both side getting 100 points. But, due to fear of winding up in box B or C, we wind up in box D...clearly, not the best box.

With bitcoin, the fear would be that the other side might amass a stockpile of BTC. And, if we did not, then they would then have a huge economic power imbalance over us. So, rationally, both sides should begin to gather BTC to avoid such an economic imbalance.

Just like with the nuclear arms race, box D is the rational outcome in the Bitcoin Cold War.

With the hard-coded scarcity of bitcoin and with multiple players in the international game (not only the two players in the Prisoner's Dilemma), the numbers become not only an incentive to get and hoard BTC, but a flywheel of an impetus driving acquisition. There's one other factor that plays into starting a bitcoin Cold War: the US already has economic hegemony as it enjoys having the US dollar as the world's de facto reserve currency. This fact is exactly the motivation behind BRICS and its challenge to USD. Although BRICS may wish to create a CBDC of some sort, stockpiling BTC to back that CBDC still exists as a very real possible part of that plan. At this point, NOT doing so would almost be irresponsible.

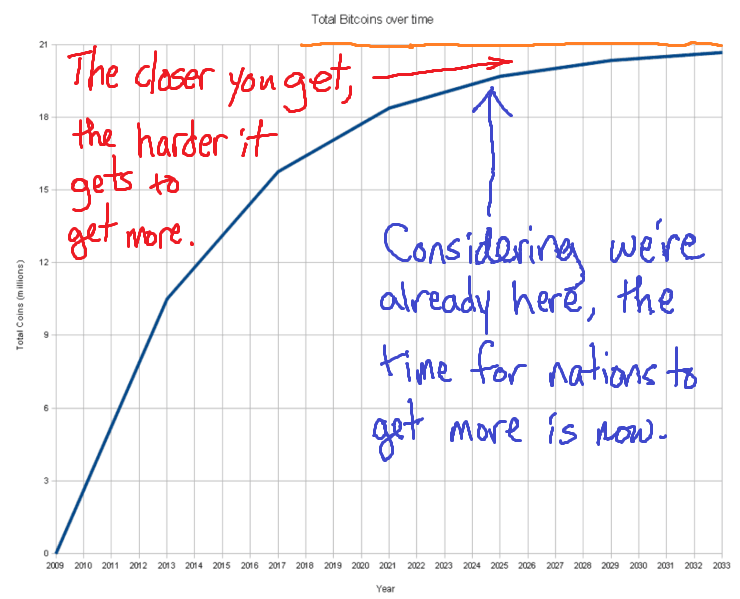

What's more, time is at play as well. I'm reminded of Einstein's E=mc² which I don't understand. As my chipmunk brain figures, if a rocket was accelerating and getting close to the speed of light, it would take more and more and more energy to keep accelerating, this to the point where it would become impossible to finally reach that speed. So, it never gets there. This never-gets-there with BTC is because of (1) scarcity, of course, and (2) the market order book. Taking the US as an example, and if the US holds 200,000 BTC currently and wishes to get to Sen. Lummis' goal of 1 million, the States need to buy 800,000 more BTC.

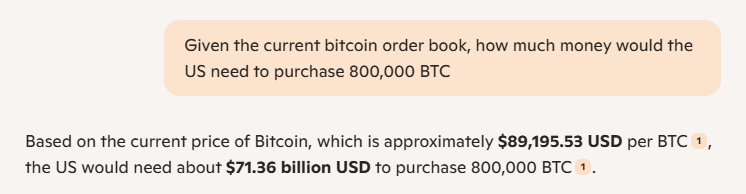

However, it's not simply 800,000 times current market price. The more that is bought, the more the order book is gnawed away. The means the current spot market prices increases. I tried to estimate the amount of money that would be needed to buy 800k BTC given the current order book and market depth, but I failed. Maybe someone else can figure it out. Anyway, it's more than the $71.4B that Microsoft Copilot told me:

Accumulating bitcoin might be seen in same way as with the nuclear arms race and Einstein's theory. If we're not going to get to the speed of light, but we still want to go faster than anyone else, it may be best for a nation to buy bitcoin now.

For nations to avoid being left behind in this game of game theory, the best and smartest move may be to begin accumulating bitcoin now. The Prisoner's Dilemma tells us that the possible consequences of NOT doing so are simply not an option. The rational choice is to stack.